Textile industry buckled up to face the brunt of GST

YarnsandFibers News Bureau 2017-06-05 10:00:00 – New DelhiThe Goods and Services Tax seems all set for its July 1 rollout, with finance minister Arun Jaitley confident of keeping this launch date despite doubts by the lone dissenter, West Bengal's chief minister, who sought more time.

As the Union Minister Arun Jaitely announced an imposition of 5 percent tax on cotton fibre, yarn and fabric from the erstwhile zero percent tax. Textile industry buckled up to face the brunt of GST. However, some states used to levy a value added tax of 2-4 percent on the cotton yarns and fabrics.

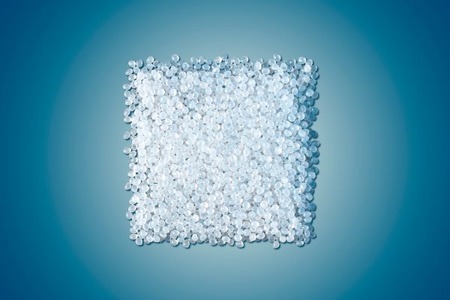

While silk and jute will attract no taxes, man-made synthetic fibres are put in the 18 percent tax slab under GST. All apparels will attract 12 percent tax against a 6-7 percent tax levied till now, whereas apparels costing below Rs 1000 will only attract 5 percent tax.

The imposition of taxes on the fabrics is likely to send the prices of a variety of goods including the readymade garments on an ascent. Furthermore, as Jaitely also clarified that the input credit above the prescribed limit will not be granted to the textile manufacturers.

However, the low taxes on cotton fabrics will improve the cotton-produce demand from the farmers, also making the cotton segment more competitive in the global race.

Among the other items exempted under GST in the textiles category, blankets and travelling rugs, curtains, bed linen, toilet linen and kitchen linen, of terry towelling or similar terry fabrics of value below Rs 1,000 will attract a five percent tax.

This move will encourage the industry to become more organized, and help GJF to take them towards the path of accountability and transparency.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide