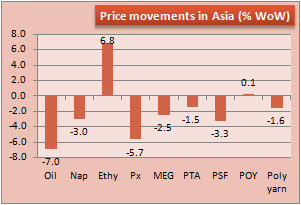

Polyester pricing moderates across the value chain

YarnsandFibers News Bureau 2015-03-25 17:19:00 – MumbaiIn the week ended 20 March, prices of polyester chain moderated a bit after generally rising earlier on cost support. While crude oil prices were up as US$ weakened on US interest hike uncertainty, Greece issue and report of a new four-year low in the number of rigs drilling oil in US, the impact was otherwise on the downstream derivatives. US crude jumped 4 per cent week end and European Brent snapped two straight weeks of losses as Iran struggled to reach a nuclear deal with world powers. Naphtha, the starting point for all petrochemicals, saw CFR Japan naphtha benchmark close the week up US$15.60 while European naphtha market ended on a strong note with support coming from tight prompt supply, steady end-users demand and a slight increase in gasoline blending.

Despite firming energy complex ethylene prices continued to remain under pressure of supply crunch in Asia while deepsea cargoes were heard arriving from US, Europe as the arbitrage window was open. In US, spot rose higher following several outages while trade in Latin America was paused for the period as Brazil producers ponder export possibilities while downstream pricing spiked amid firmer demand. European ethylene spot prices rose on tight prompt material. Paraxylene prices in Asia declined sharply as both upstream and downstream remained unsupportive. This led to decline in US paraxylene market which also faced weak demand. Asian paraxylene markers were down US$48 on the week while US spot price fell US$50 week on week.

Asian MEG prices were down on aggressive selling and falling Futures wile European MEG climbed on support of firm PET demand. Despite falling spot, MEGlobal raised its North American benchmark for MEG by US cent 1 per pound for April. PTA prices softened in Asia given the continuing glut in China. Players however, expect bearish sentiment to prevail in the near to midterm. In Europe, PTA spot remained unchanged, as it found support from further downstream PET market. Asian MEG spot prices slipped US$21 a ton week on week while PTA markers lost another US$10 a ton CFR China. Polyester chip markets weakened as oil prices tumbled last week and trades were thin over the weekend, and some offers were revised down sharply. Offers for semi dull chips fell US$50-60 a ton on the week while those for super bright chip were down US$30-50 a ton.

In China, PFY trading varied from producer to producer as some reported low-end numbers. In Fujian, PFY trading was sluggish amid thin participation and steady cost. In Jiangsu and Zhejiang, PFY prices were generally lower and discounts were available. Inventory was relatively low. In Pakistan, polyester filament markets were stable to weak amid thin trading. DTY prices were revised down amid tepid trading, and inventory level increased slightly. Regular yarns saw lower off-take volumes. In India, prices of POY were stable amid weak trading. Many producers were producing for downstream DTY units that seemed to show restocking interest recently. PFY markets are expected to remain stable in short term.

In China, POY 75/72 and 75/36 were steady while Indian POY 130/34 prices rolled over. In Pakistan, DTY prices for 300/96 were down PakRs2. Polyester fibre markets were depressed on the whole by continuous fall in raw material costs emerging from the crude oil markets. In India and Pakistan, trading was done on a need-to basis as the markets were mostly bearish with few enquiries and trades heard. In Jiangsu and Zhejiang an d Fujian, 1.4D direct-melt-spun PSF was down US cents 4 per kg from last week. In Pakistan, prices in Karachi were up PakRs2 a kg while PSF prices were stable in India.

Polyester yarn trading was slightly lukewarm in China, with prices in weak correction on the whole. Meanwhile, spun polyester yarn eyed listless transaction and overall trading was limited this week. Spun polyester yarn makers gradually returned to normal production after holidays, but sales were below satisfaction. Some makers still held raw material stocks built before the holiday. In India, despite the hike in polyester fibre prices for March, spun polyester yarn prices remained stable over the past three weeks. In Qianqing, offers for 32s were down US cents 3 on the week. In India, polyester yarn 30 yarns for knitting were pegged stable in Ludhiana while they rose INR1 in Indore market.

Courtesy: YnFx Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide