Cheap cotton and automation is pushing textile industry in US South

YarnsandFibers News Bureau 2015-08-05 16:00:00 – USIn China, manufacturing wages adjusted for productivity have almost tripled over the last decade, to an estimated $12.47 an hour last year from $4.35 an hour in 2004. China’s surging labor and energy costs are weakening its competitiveness in manufacturing, according to the Boston Consulting Group.

Boston Consulting has estimated that for every $1 required to manufacture in the United States, it costs 96 cents to manufacture in China. Yarn production costs in China are now 30 percent higher than in the United States, according to the International Textile Manufacturers Federation.

The prospect of a sweeping Pacific trade agreement led by the United States, and excludes China, is also driving Chinese yarn companies to gain a foothold here, lest they be shut out of the lucrative American market.

The inner workings of Keer’s factory in Lancaster County help demonstrate why yarn can now be produced for such a low cost in the United States and point to the kind of capital-intensive manufacturing that could thrive again in America.

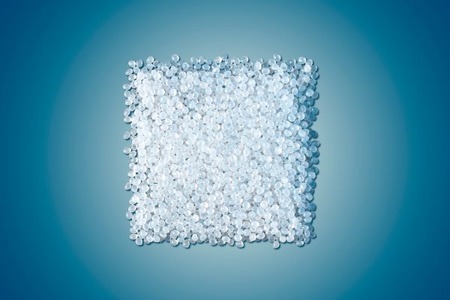

Inside the 230,000-square-foot spinning plant, giant machines help clean the seeds and dirt from the cotton and send the fluff into carding machines that assemble the cotton into thick, long ropes of fiber. Workers then feed the ropes into machines that spin the cotton into spools of yarn or thread.

The work is highly automated, with the factory’s 32 production lines churning out about 85 tons of yarn a day. Even when Keer opens a second factory next year, it will hire just 500 workers, a fraction of the thousands of workers who toiled at cotton mills across the South for much of the 19th and 20th centuries — a big reason Keer is able to keep costs down.

U.S. fashion companies are NOT moving away from China, but they are actively seeking supplementary sourcing destinations. Despite the concern about rising costs in China in recent years, when asked how their sourcing value or volume from China will change in the next two years, as many as 43 percent expect no change, or even a slight increase. Another 47 percent expect sourcing value or volume from China will decrease in the next two years, but only to a slight degree. Less than 7 percent of respondents say that they expect to significantly decrease sourcing from China.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide