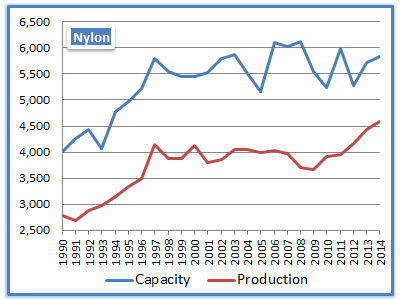

World Nylon Fiber - Trend in Demand & Supply 2015

Features

- In 2014, apparent consumption in West Europe declined 1.5% year on year while domestic supplies shrank 8.9%.

- YnFx predicts that nylon consumption would touch 5.10 million tons by 2020, increasing at an annual rate of 1.3% since end 2014.

- Global nylon monofilament market demand is expected to reach 476,400 tons, growing at a annual rate of 5.2% up to 2020.

report content

| PREFACE | 5 |

| LIST OF TABLES | 7 |

| FIBRE WORLD 2014 | 9 |

| Global Economy in Low Gear | 9 |

| Fibre Growth Slows Down in 2014 | 9 |

| Supply and Demand in 2014 | 11 |

| World Statistics | 14 |

| NYLON | 21 |

| 75 Year since invented, Nylon still counting | 21 |

| Nylon in 2014 | 22 |

| The monofilament story | 23 |

| Nylon statistics | 25 |

| ABOUT YARNSANDFIBERS | 55 |

list of tables

| Table 1.1. Growth and Share of Fibres | 10 |

| Table 1.2. Growth of Natural Fibres' Production | 10 |

| Table 1.3. Growth in Manmade Fibre / Filament wise Production | 10 |

| Table 1.4. World Supplies of Fibres and Filaments in Primary Form in 2014 | 13 |

| Table 1.5. Trends in Fibre / Filament Production | 14 |

| Table 1.6. Trends in Fibre / Filament Exports | 14 |

| Table 1.7. Trends in Fibre / Filament Imports | 15 |

| Table 1.8. Trends in Fibre / Filament Apparent Consumption | 15 |

| Table 1.9. Trends in Manmade Fibre / Filament wise Capacity | 16 |

| Table 1.10. Trends in Manmade Fibre / Filament wise Production | 16 |

| Table 1.11. Trends in Manmade Fibre / Filament wise Export | 17 |

| Table 1.12. Trends in Manmade Fibre / Filament wise Import | 17 |

| Table 1.13. Trends in Manmade Fibre / Filament wise Apparent Consumption | 18 |

| Table 1.14. Trends in Natural Fibre wise Production | 18 |

| Table 1.15. Trends in Natural Fibre wise Exports | 19 |

| Table 1.16. Trends in Natural Fibre wise Imports | 19 |

| Table 1.17. Trends in Natural Fibre wise Apparent Consumption | 20 |

| Table 3.1. Major Nylon (S+F) Suppliers an Consumers | 24 |

| Table 3.2. Demand/Supply Trends in Nylon (S+F) | 25 |

| Table 3.3. Trends in Nylon (S+F) Capacity By-Region | 25 |

| Table 3.4. Trends in Nylon (S+F) Production By-Region | 26 |

| Table 3.5. Trends in Nylon (S+F) Exports By-Region | 26 |

| Table 3.6. Trends in Nylon (S+F) Imports By-Region | 27 |

| Table 3.7. Trends in Nylon (S+F) Apparent Consumption By-Region | 27 |

| Table 3.8. Demand/Supply Trends in Nylon (S+F) in Africa | 28 |

| Table 3.9. Trends in Nylon (S+F) Capacity in Africa | 28 |

| Table 3.10. Trends in Nylon (S+F) Production in Africa | 29 |

| Table 3.11. Trends in Nylon (S+F) Exports from Africa | 29 |

| Table 3.12. Trends in Nylon (S+F) Imports in Africa | 30 |

| Table 3.13. Trends in Nylon (S+F) Apparent Consumption in Africa | 30 |

| Table 3.14. Demand/Supply Trends in Nylon (S+F) in Asia | 31 |

| Table 3.15. Trends in Nylon (S+F) Capacity in Asia | 31 |

| Table 3.16. Trends in Nylon (S+F) Production in Asia | 32 |

| Table 3.17. Trends in Nylon (S+F) Exports from in Asia | 32 |

| Table 3.18. Trends in Nylon (S+F) Imports in Asia | 33 |

| Table 3.19. Trends in Nylon (S+F) Apparent Consumption in Asia | 33 |

| Table 3.20. Demand/Supply Trends in Nylon (S+F) in CIS | 34 |

| Table 3.21. Trends in Nylon (S+F) Capacity in CIS | 34 |

| Table 3.22. Trends in Nylon (S+F) Production in CIS | 35 |

| Table 3.23. Trends in Nylon (S+F) Exports from CIS | 35 |

| Table 3.24. Trends in Nylon (S+F) Imports in CIS | 36 |

| Table 3.25. Trends in Nylon (S+F) Apparent Consumption in CIS | 36 |

| Table 3.26. Demand/Supply Trends in Nylon (S+F) in Central and East Europe | 37 |

| Table 3.27. Trends in Nylon (S+F) Capacity in Central and East Europe | 37 |

| Table 3.28. Trends in Nylon (S+F) Production in Central and East Europe | 38 |

| Table 3.29. Trends in Nylon (S+F) Exports from Central and East Europe | 38 |

| Table 3.30. Trends in Nylon (S+F) Imports in Central and East Europe | 39 |

| Table 3.31. Trends in Nylon (S+F) Apparent Consumption in Central and East Europe | 39 |

| Table 3.32. Demand/Supply Trends in Nylon (S+F) in Middle East | 40 |

| Table 3.33. Trends in Nylon (S+F) Capacity in Middle East | 40 |

| Table 3.34. Trends in Nylon (S+F) Production in Middle East | 41 |

| Table 3.35. Trends in Nylon (S+F) Exports from Middle East | 41 |

| Table 3.36. Trends in Nylon (S+F) Imports in Middle East | 42 |

| Table 3.37. Trends in Nylon (S+F) Apparent Consumption in Middle East | 42 |

| Table 3.38. Demand/Supply Trends in Nylon (S+F) in North America | 43 |

| Table 3.39. Trends in Nylon (S+F) Capacity in N. America | 43 |

| Table 3.40. Trends in Nylon (S+F) Production in N. America | 44 |

| Table 3.41. Trends in Nylon (S+F) Exports from N. America | 44 |

| Table 3.42. Trends in Nylon (S+F) Imports in N. America | 45 |

| Table 3.43. Trends in Nylon (S+F) Apparent Consumption in N. America | 45 |

| Table 3.44. Demand/Supply Trends in Nylon (S+F) in Oceania | 46 |

| Table 3.45. Trends in Nylon (S+F) Capacity in Oceania | 46 |

| Table 3.46. Trends in Nylon (S+F) Production in Oceania | 47 |

| Table 3.47. Trends in Nylon (S+F) Exports from Oceania | 47 |

| Table 3.48. Trends in Nylon (S+F) Imports in Oceania | 48 |

| Table 3.49. Trends in Nylon (S+F) Apparent Consumption in Oceania | 48 |

| Table 3.50. Demand/Supply Trends in Nylon (S+F) in Central and South America | 49 |

| Table 3.51. Trends in Nylon (S+F) Capacity in South America | 49 |

| Table 3.52. Trends in Nylon (S+F) Production in South America | 50 |

| Table 3.53. Trends in Nylon (S+F) Exports from South America | 50 |

| Table 3.54. Trends in Nylon (S+F) Imports in South America | 51 |

| Table 3.55. Trends in Nylon (S+F) Apparent Consumption in South America | 51 |

| Table 3.56. Demand/Supply Trends in Nylon (S+F) in West Europe | 52 |

| Table 3.57. Trends in Nylon (S+F) Capacity in West Europe | 52 |

| Table 3.58. Trends in Nylon (S+F) Production in West Europe | 53 |

| Table 3.59. Trends in Nylon (S+F) Exports from in West Europe | 53 |

| Table 3.60. Trends in Nylon (S+F) Imports in West Europe | 54 |

| Table 3.61. Trends in Nylon (S+F) Apparent Consumption in West Europe | 54 |

Reports by industry

Why you should subscribe?

01

Quick and better decision-making

02

Increased competitive advantage

03

Superior strategy and accurate planning

Who Should Buy?

- Producers and buyers of textiles commodities

- Apparel & garment makers and suppliers

- Textile machinery suppliers

- Textile chemical buyers and sellers

- Textile accessories supplier

- Traders and merchandisers in textile value chain

- Government agencies

- Financial institutions

- Professional service providers

- Consultants and advisors

why us?

21

yrs

experience

Fortune 500

Customer Base

100%

dedicated team

55+

Countries Served Worldwide

Market Intelligence

Our Clients