World Natural Fibre Report 2015

Features

- Global cotton production fell 6% to 24.3 million tons resulting from 6% shrinkage acreage to 31.75 million hectares in 2014-15.

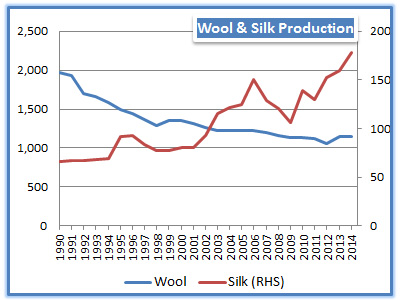

- Worldwide wool production dropped 0.4% in 2014 in most major wool producing countries, valued at US$9 billion.

- Global wool trade fell 5% as exports totaled 931,000 tons in 2014.

report content

| PREFACE | 5 |

| LIST OF TABLES | 7 |

| FIBRE WORLD 2014 | 9 |

| Global Economy in Low Gear | 9 |

| Fibre Growth Slows Down in 2014 | 9 |

| Supply and Demand in 2014 | 11 |

| World Statistics | 14 |

| COTTON | 21 |

| Three Countries Consumed two-thirds of cotton | 21 |

| Cotton in 2014 | 22 |

| Cotton statistics | 24 |

| WOOL | 49 |

| Supply remained flat | 49 |

| Wool Fibre Statistics | 50 |

| SILK | 51 |

| Production Jumps | 51 |

| Silk Statistics | 52 |

| OTHER NATURAL FIBRES | 53 |

| Abaca | 53 |

| Coir | 53 |

| Flax | 53 |

| Hemp | 54 |

| Jute | 54 |

| Sisal | 54 |

| Ramie | 55 |

| Alpaca | 55 |

| Angora | 55 |

| Camel Hair | 55 |

| Cashmere | 56 |

| Mohair | 56 |

| Other Natural Fibre Statistics | 57 |

| ABOUT YARNSANDFIBERS | 59 |

list of tables

| Table 1.1. Growth and Share of Fibres | 9 |

| Table 1.1. Growth and Share of Fibres | 10 |

| Table 1.2. Growth of Natural Fibres' Production | 10 |

| Table 1.3. Growth in Manmade Fibre / Filament wise Production | 10 |

| Table 1.4. World Supplies of Fibres and Filaments in Primary Form in 2014 | 13 |

| Table 1.5. Trends in Fibre / Filament Production | 14 |

| Table 1.6. Trends in Fibre / Filament Exports | 14 |

| Table 1.7. Trends in Fibre / Filament Imports | 15 |

| Table 1.8. Trends in Fibre / Filament Apparent Consumption | 15 |

| Table 1.9. Trends in Manmade Fibre / Filament wise Capacity | 16 |

| Table 1.10. Trends in Manmade Fibre / Filament wise Production | 16 |

| Table 1.11. Trends in Manmade Fibre / Filament wise Export | 17 |

| Table 1.12. Trends in Manmade Fibre / Filament wise Import | 17 |

| Table 1.13. Trends in Manmade Fibre / Filament wise Apparent Consumption | 18 |

| Table 1.14. Trends in Natural Fibre wise Production | 18 |

| Table 1.15. Trends in Natural Fibre wise Exports | 19 |

| Table 1.16. Trends in Natural Fibre wise Imports | 19 |

| Table 1.17. Trends in Natural Fibre wise Apparent Consumption | 20 |

| Table 6.1. Major Cotton Fibre Suppliers and Consumers | 23 |

| Table 6.2. Demand/Supply Trends in Cotton Fibre | 24 |

| Table 6.3. Trends in Area under Cotton By Region | 24 |

| Table 6.4. Trends in Cotton Fibre Production By Region | 25 |

| Table 6.5. Trends in Cotton Fibre Exports By Region | 25 |

| Table 6.6. Trends in Cotton Fibre Imports By Region | 26 |

| Table 6.7. Trends in Cotton Fibre Apparent Consumption By Region | 26 |

| Table 6.8. Demand/Supply Trends in Cotton Fibre in Africa | 27 |

| Table 6.9. Trends in Area under Cotton in Africa | 27 |

| Table 6.10. Trends in Cotton Fibre Production in Africa | 28 |

| Table 6.11. Trends in Cotton Fibre Exports from Africa | 28 |

| Table 6.12. Trends in Cotton Fibre Imports in Africa | 29 |

| Table 6.13. Trends in Cotton Fibre Apparent Consumption in Africa | 29 |

| Table 6.14. Demand/Supply Trends in Cotton Fibre in Asia | 30 |

| Table 6.15. Trends in Area under Cotton in Asia | 30 |

| Table 6.16. Trends in Cotton Fibre Production in Asia | 31 |

| Table 6.17. Trends in Cotton Fibre Exports from in Asia | 31 |

| Table 6.18. Trends in Cotton Fibre Imports in Asia | 32 |

| Table 6.19. Trends in Cotton Fibre Apparent Consumption in Asia | 32 |

| Table 6.20. Demand/Supply Trends in Cotton Fibre in CIS | 33 |

| Table 6.21. Trends in Area under Cotton in CIS | 33 |

| Table 6.22. Trends in Cotton Fibre Production in CIS | 34 |

| Table 6.23. Trends in Cotton Fibre Exports from CIS | 34 |

| Table 6.24. Trends in Cotton Fibre Imports in CIS | 35 |

| Table 6.25. Trends in Cotton Fibre Apparent Consumption in CIS | 35 |

| Table 6.26. Demand/Supply Trends in Cotton Fibre in Central and East Europe | 36 |

| Table 6.27. Demand/Supply Trends in Cotton Fibre in Middle East | 36 |

| Table 6.28. Trends in Area under Cotton in Middle East | 37 |

| Table 6.29. Trends in Cotton Fibre Production in Middle East | 37 |

| Table 6.30. Trends in Cotton Fibre Exports from Middle East | 38 |

| Table 6.31. Trends in Cotton Fibre Imports in Middle East | 38 |

| Table 6.32. Trends in Cotton Fibre Apparent Consumption in Middle East | 39 |

| Table 6.33. Demand/Supply Trends in Cotton Fibre in North America | 39 |

| Table 6.34. Trends in Area under Cotton in N. America | 40 |

| Table 6.35. Trends in Cotton Fibre Production in N. America | 40 |

| Table 6.36. Trends in Cotton Fibre Exports from N. America | 41 |

| Table 6.37. Trends in Cotton Fibre Imports in N. America | 41 |

| Table 6.38. Trends in Cotton Fibre Apparent Consumption in N. America | 42 |

| Table 6.39. Demand/Supply Trends in Cotton Fibre in Oceania | 42 |

| Table 6.40. Demand/Supply Trends in Cotton Fibre in Central and South America | 43 |

| Table 6.41. Trends in Area under Cotton in South America | 43 |

| Table 6.42. Trends in Cotton Fibre Production in South America | 44 |

| Table 6.43. Trends in Cotton Fibre Exports from South America | 44 |

| Table 6.44. Trends in Cotton Fibre imports in South America | 45 |

| Table 6.45. Trends in Cotton Fibre Apparent Consumption in South America | 45 |

| Table 6.46. Demand/Supply Trends in Cotton Fibre in West Europe | 46 |

| Table 6.47. Trends in Area under Cotton in West Europe | 46 |

| Table 6.48. Trends in Cotton Fibre Production in West Europe | 47 |

| Table 6.49. Trends in Cotton Fibre Exports from in West Europe | 47 |

| Table 6.50. Trends in Cotton Fibre Imports in West Europe | 48 |

| Table 6.51. Trends in Cotton Fibre Apparent Consumption in West Europe | 48 |

| Table 7.1. Demand/Supply Trends in Wool Fibre | 50 |

| Table 8.1. Demand/Supply Trends in Silk | 52 |

| Table 9.1. World Supplies of Natural Fibres in 2012 (Other than Cotton, Wool & Silk) | 57 |

| Table 9.2. Trends in Exports of Other Natural Fibres | 57 |

Reports by industry

Why you should subscribe?

01

Quick and better decision-making

02

Increased competitive advantage

03

Superior strategy and accurate planning

Who Should Buy?

- Producers and buyers of textiles commodities

- Apparel & garment makers and suppliers

- Textile machinery suppliers

- Textile chemical buyers and sellers

- Textile accessories supplier

- Traders and merchandisers in textile value chain

- Government agencies

- Financial institutions

- Professional service providers

- Consultants and advisors

why us?

21

yrs

experience

Fortune 500

Customer Base

100%

dedicated team

55+

Countries Served Worldwide

Market Intelligence

Our Clients