Will the crude oil price free fall stop, will chemical fibres react?

YarnsandFibers News Bureau 2014-12-16 13:15:00 – MumbaiCrude oil prices have retreated US$50-53 per barrel or US$360-390 a ton since its peak of June 2014. More than that, the first two weeks of December has already seen them falling more than US$11 a barrel, the fastest drop in a shortest period not heard in recent years. International benchmarks have touched new five-year lows on 12 December after the world's energy watchdog forecast even lower prices on weaker demand and larger supplies next year.

International Energy Agency, the Paris-based agency which coordinates the energy policies of industrialised countries, cut its outlook for demand growth in 2015, triggering another collapse. It slashed its demand growth for 2015 by 230,000 barrels per day to 900,000 bpd on expectations of lower fuel consumption in Russia and other oil-exporting countries.

Brent crude oil settled at below US$62 a barrel while US crude oil future slumped to below US$58 extending previous landmark falling below $60. The other factors which have been pulling down price are surging inventories in the US and top oil exporter Saudi Arabia's reiteration that it will not cut production. Further, oil-producing economies outside the OPEC will add to global supplies.

At the close of week ending 12 December, Brent had settled at US$61.85 per barrel, the lowest since July 2009 and US crude finished at US$57.81, its lowest since May 2009. Both markets have lost about 46 per cent of their value since their June highs, when Brent stood at above US$115 and US crude at around US$107.

The Recovery

According to YnFx, oil prices are predicted to recover mildly from February 2015 and pick-up momentum in April. The reversal will stem from prospect of economic revival in the US and Europe from second quarter of 2015 onwards, refreshing demand for petroleum products. Also tapering incremental inventories in the US will be a major supporting factor.

Impact on downstream

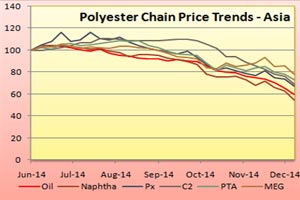

The impact of falling energy complex is discernable across chemical fibre chains including polyester, nylon and acrylic in Asia, Europe and the US. However, each layer in the value chain will have a lag to absorb the cost reduction since their current raw material inventory was built at higher prices. The percolation which is at a lag, begins quickly in the immediate downstream segment and slowly at the end of the value chain, ceteris paribus. For example, crude oil prices fell 43% between the peak of June 2014 and mid-December, naphtha followed suite falling in same intensity.

The last leg in the polyester chain, polyester staple and filament saw price fall 20% and 10% respectively in Asian markets while the same in Europe and US were yet to react.

Similarly, in the nylon chain benzene market was the immediate casualty, where prices declined more than 50% during the period under review. Filament yarns were least affected. Acrylic chain portrayed similar trends, excepting intermediates, caprolactum and acrylonitrile. Following exhibit will prove the case.

Courtesy: YnFx Weekly Price Watch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide