Will falling crude oil initiate cost easing for polyester makers?

YarnsandFibers News Bureau 2014-09-30 15:59:00 – MumbaiCrude oil prices have lost US$14.23 since their recent peak of US$106.62 per barrel as of 20 June 2014. And this had a decelerating impact on naphtha and its derivatives. Naphtha prices have crashed from US$982 a ton to US$849 a ton over the same period. The polyester industry has trying to adjust to this massive change. As of last week of September, Brent crude for November delivery settled at US$97 a barrel while US November crude settled at US$93.54 a barrel. Both crude benchmarks remained on pace for a third straight monthly loss.

Fibre makers are adjusting their pricing to pass on the cost benefit but spinners are waiting on the sidelines, expecting fibre prices to fall further. PSF price has already dwindled to below US$1.50 a kg mark. In China, 1.4D direct-melt-spun PSF prices fell to US$1.45-1.46 a kg in Jiangsu and Zhejiang, losing US cents 17 in the comparable period. In Pakistan, prices in Karachi were down US$1.57-1.61 a kg, as imports were cheaper from China. Polyester filament markets saw no exception to this fall. In China, POY 75/72 and 75/36 were traded in at US$1.54-1.58 a kg, cheaper by almost US cents 17 between mid-June and end-September. Indian POY 130/34 prices were at US$1.94 a kg.

Spun polyester yarn makers saw margins improving since yarn prices have not fallen in the same intensity like fibres'. 32s spun polyester yarn prices in China although fell to US$2.11-2.13 a kg, the spread between fibre and yarn was up at US cents 66, from US cents 61 as of mid-June. But here too, spinners saw fresh orders trickling down of late as demand was still rigid.

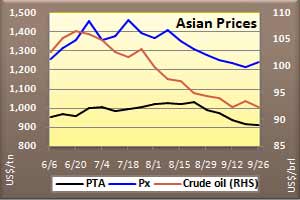

Paraxylene and PTA, the key raw material for making polyester fibre and filament saw prices in Asian markets average US$1,238 a ton and US$935 a ton, respectively FOB Korea in September. They were down US$109 and US$36 from June average. This also pushed polyester chip, semi dull filament grade, down to US$1,475 a ton from US$1,640 a ton in June.

Crude oil prices are likely to fall below US$90 a barrel in October on plentiful supplies. Brent has fallen mostly since hitting this year's high in June as investors focused on a well supplied market and prices touched a 26-month trough in the third week of September. The oil benchmark was on track for its deepest quarterly drop in more than two years on plentiful supplies. US commercial crude oil and distillate stockpiles too, are estimated to have increased in the last week of September.

Falling crude will again percolate into easing cost in the polyester chain, at least in the last quarter of 2014, where prices will remain at sub US$90 levels, before rising back to above that mark in early 2015.

In the interim, crude oil may get some support from upward revision of gross domestic product data from Europe and other regions and firm US economic indicators. Oil demand, especially in the US, is showing signs of firmness. Activity in China's vast factory sector showed signs of steadying in September as export orders climbed, easing fears of a hard landing but pointing to a still sluggish economy facing considerable risks.

Courtesy: YnFx Weekly PriceWatch Report and Daily Textile Prices service

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide