Sluggish trend continues in polyester as markets seek direction

YarnsandFibers News Bureau 2015-06-15 16:55:00 – MumbaiEthylene market was assessed flat as sluggish trading continued but prices were up in the week ended 12 June 2015 and the diverge trend continued between NE and SE Asia. European spot prices fell as bearish sentiment worked on both supply and demand while derivative, particularly LDPE saw its first fall in three months. In US, ethylene spot slipped as Dow resumes production at Louisiana facility.

During the week, paraxylene prices firmed up but fluctuated on sluggish crude oil market and weakening PTA values. In Europe, paraxylene spot rose on firmer crude while June contract price remained unchanged from May leaving spot prices at a 15 per cent discount to ECP. US paraxylene spot tracked Asia hike while the spread between mixed xylene and paraxylene remained negative.

Asian MEG markets were under correction from previous week's bullish rebound as players were mulling the effect of waning polyester demand and reduced operating rates in China’s polyester and PET plants on feedstock MEG and PTA spot prices. European MEG price was stable amid short supply as force majeure continued while downstream derivatives exerted bearish influence on the market. In US, spot MEG price held stable on the week, as fundamentals remained consistent and interest in exporting to Europe increased while supplies were seen tightening. PTA prices moderated in Asian markets as the spate plant issues subsided and attention turned to waning demand for PET and polyester. In Europe, PTA price remained unchanged for the third consecutive week. Polyester chip markets fluctuated as raw material pricing tended to be in uncertain direction.

Sustained weakness in semi dull chip market led to the drop in offers in China amid insipid trading. Both continuous polymerised semi dull and super bright filament grade chip were cheaper in the week of 12 June.

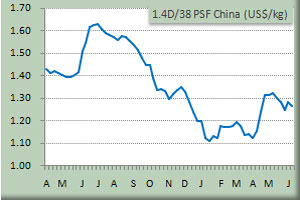

Polyester filament yarn markets were quiet prima facie, but pressure existed on producers who intended to expand sales and cut inventory by offering discounts on firm deals. The pressure was also caused by weak cost and limited buying. In India, POY market was range bound and producers pegged offers largely stable. In Pakistan, traders pegged offers for DTYs stable, and a few specs were offered lower. PSF markets were on a decline in China and turned bearish on the whole during the week. Producers pegged most offers stable, and raised a few specs. Prices in India and Pakistan rolled over further dampening market outlook.

For more details see: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide