PTA producers managed to lift price, but spot relents

YarnsandFibers News Bureau 2014-06-24 11:32:00 – MumbaiAsian PTA prices gave back some of its recent gains despite continuous soaring feedstock paraxylene prices since early May (0.66 unit paraxylene required to produce 1 unit of PTA). The tighter domestic PTA market in China was found easing in the week ended 20 June. Sinopec restarted its four PTA plants across China on 18 June, boosting paraxylene sentiment as demand will resume from these four units, hence prices soared in the week. The contract price for PX in Asia failed to reach a settlement for June, the eighth time in the last 10 months leaving PTA makers to enter spot. Earlier in the month, PTA producers had proposed to change the formula used for settling the PTA term contract price by linking to spot paraxylene prices.

PTA producers in China had managed to constrain supply by cutting operating rates, and increase prices. However, such a manoeuvre worked only for a couple of weeks. And by then the rest of the polyester chain, both upstream and downstream fibres, joined in with their own price increases which continued into the third week of June. However, the negative response from the spinning mills was mounting as volumes were being reduced. Other than Asian region, PTA markets in US were awaiting for the settlement of paraxylene contract, before the June prices could be finalized.

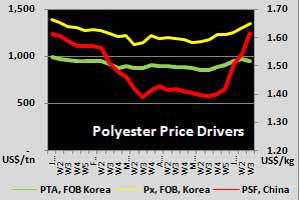

Asian paraxylene prices gained US$42.50 to be assessed at US$1,357.50-1,358.50 a ton FOB Korea and US$1,377.50-1,378.50 a ton CFR Taiwan/China in the week ended 20 June. They have gained almost US$200 a ton in the past six weeks. US spot paraxylene prices soared US$50 week on week, assessed at US$1,280 a ton FOB USG, while European spot jumped US$40 to US$1,280 a ton FOB ARA. Asian PTA markers fell US$13 a ton on the week to be assessed at US$952 a ton CFR China. Offers for bonded cargoes fell to US$955 a ton, with discussions at US$945-950 a ton.

The influence of PTA Futures over MEG appears halted abruptly as price fell despite a late-week surge in PTA futures. In Europe, a June contract MEG price was settled below May number while talks were firmer in US MEG market. MEG prices fell US$7 on the week in Asia to an assessment of US$994-999 a ton CFR China and US$998-1,000 a ton CFR Southeast Asia. In US, MEG prices were assessed at US cents 43.50-44.50 per pound FOB USG, up US cent 0.50 week on week.

Polyester chip markets were under influence of cost pressure and producers raised offers to safeguard their margins, although downstream demand was still poor. PFY markets continued to show low activity as both PTA and MEG spot lost some of their gains seen in recent weeks. PSF prices in Asian markets were seen firming extending week-ends gains week on week. Since early May, PSF has become dearer by more than US cents 20 a kg in China. However, terminal demand was slow to pick, and PSF producers were confronted with difficulty in increasing sales post PSF price hike.

COURTESY: Weekly PriceWatch Report and Daily Textile Prices

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide