Polyester pricing softening across the value chain

YarnsandFibers News Bureau 2015-06-30 17:29:00 – MumbaiPolyester pricing has been on a sluggish mode ever since crude oil price began to dwindle with occasional peaks and troughs. In the week ended 19 June, polyester upstream feedstock, ethylene markets in Asia gave back earlier week’s gains as prices were dragged down by rising regional and deep-sea supplies. However, the price drop was limited by cracker shutdowns. Asian markers fell US$5-10 a ton week on week. Prices were down Euro14 a ton both on FD NWE and CIF NWE basis. In contrast with these two markets, US spot climbed US cent 0.50 per pound on the week after Evangeline start up.

The other feedstock, paraxylene prices gained across regions supported by downstream PTA markets and rising mixed xylene prices on the week. Singapore’s Jurong Aromatics Corp. announced that it will not restart its aromatics plant before Q3. Asian markers were up US$8 a ton FOB Korea and CFR Taiwan/China, on the week. In US, spot levels were consistent with Asia but production economics remained unviable. Spot assessments rose US$50 a ton FOB USG. European paraxylene spot also rose US$6 a ton FOB ARA on the week.

Mono ethylene glycol, one the twin raw material for making polyester, saw prices falling in Asia on short selling and bearish polyester markets. As the summer demand season drew to a close, players were increasingly worried about the reduced operating rates at major PET and polyester plants which they fear will dry up demand for any forward or prompt spot supply. MEG markers fell US$16 a ton CFR China and CFR Southeast Asia, on the week. MEGlobal nominated its Asian MEG contract price for July at US$1,100 a ton CFR, flat from June number. In US, spot MEG was stable with little change heard in fundamentals while European MEG June contract price was fully settled up Euro27 on the month due to tight supply an d stable to bearish spot dynamics.

Purified terephthalic acid prices, the other raw material, slipped marginally on the week as plants issue abated quietly. The fall would have been faster had several producers not bought spot cargoes to meet their contract obligations. Asian PTA markers, the CFR China and CFR Southeast Asia lost US$12 a ton on the week. European PTA price remained unchanged for the fourth consecutive week amid a rollover in the European contract price for paraxylene. In US, June PTA price remained unsettled as the market awaited the settlement of the paraxylene contract amid healthy downstream demand.

Polyester filament yarn markets saw cost support easing with upstream raw material pricing on the downtrend. Demand recovered marginally, but the overall sentiment was bearish. In China, chemical fiber plant and textile enterprises were facing liquidity issues, as demand remained low from the end-users and reported inventory pressure and sinking prices caused by tepid demand. In India, POY market was stable and activity remained thin. Offers were stable to weak, and discounts were offered to promote sales. In China, 75/72 POYs price was stable on the week at US$1.37-1.41 a kg in Shengze while 75/36 was at US$1.36-1.39 a kg. In Indian POY 130/34 prices were at US$1.44-1.46 a kg, unchanged from last week.

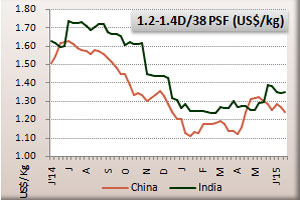

Polyester staple fibre markets weakened and prices were on a decline in the week ending 19 June as raw materials lacked spikes. The markets followed suit with few large deals reported. Producers cut prices, depressed by rising inventory level. Downstream spun polyester yarn makers had limited feedstock demand due to tepid sales. Prices in China declined while they rolled over in Pakistan and India. In Jiangsu and Zhejiang, offers for 1.4D direct-melt-spun fell US cents 3 from the previous week. In Pakistan, prices in Karachi were stable at PakRs.137-139 a kg or at US$1.35-1.37 a kg. In India, PSF prices were unchanged at INR86.25 a kg or US$1.35 a kg.

Courtesy: Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide