Off-season and costlier raw material squeezes nylon making

YarnsandFibers News Bureau 2014-07-29 17:19:00 – MumbaiNylon filament makers in Asia have been facing dual challenges in recent times. On one hand raw material cost has been galloping while on the other hand, demand is shrinking at an equal speed. This, nylon makers says, is squeezing their margins and thus they have to resort to production control, as a strategy to support even the current price levels. Volumes are lower than expected in China with the feedstock producers concerned about their cost position. Raw material suppliers are trying to increase prices into the filament producers at a time supply is exceeding demand. In response, efforts are made to increase yarn prices, but with very mixed results. In fact, separate deals are done generally below the quoted prices. In the week ended 25 July, nylon yarn buyers showed lusterless interest amid off-season, coupled with huge efforts to save energy and emission reduction, leading to limited liquidity.

In US, there have been no significant changes in a fairly weak textile filament market. Pricing appear steady but volumes are just enough to keep plants running since there is lack of confidence in customers to advance ordering. In Europe, nylon yarn prices rolled over entering Q3, with some suppliers fighting to defend prices in a traditional discounting period.

In China, semi-dull FDY70D/24F was traded at US$3.60-3.63 a kg in the week ended 25 July, rolling over from previous week. FDY40D was pegged at US$3.87-3.95 a kg. Nylon DTY 70D/24F was pegged at US$3.79-3.95 a kg, down US cents 2-3 from last week, due to weaker currency. DTY 30D/10F price were at US$4.68-4.76 a kg, unchanged from previous week.

Upstream, both nylon chip and caprolactum markets continue to derive strength from firm benzene prices. Under the combined factors of strong benzene, expectation of tight supply in the short run and low inventory, caprolactum prices were firm during the week. Asia caprolactum markers, the CFR FE and SE were flat at US$2,230-2,250 a ton while July contracts of high-end materials were mostly concluded at around US$2,300 a ton. In China, prices for solid goods were at US$2,870-2,900 a ton, up US$30 on the week while liquid goods were at US$2,890-2,920 a ton, up US$30 from last week. DSM Nanjing settled July price at US$2,945 a ton up US$60 from June settlement for solid, AA grade.

Nylon chip prices generally trended up on the back of strong movement of upstream raw materials. Besides, low inventory and cut in production by chip makers supported sentiment. However, weaker buying interest stemming from the slow price uptick in yarn sector. Semi-dull and bright conventional chips saw low buying interest and prices remained at high levels on firm cost and low inventory. Offers for Taiwan-origin chips were pegged at US$2,520-2,580 a ton. In China, offers for low-end semi-dull chips were at US$3,035-3,130 a ton and bright conventional spinning nylon-6 chips at US$3,000-3,100 a ton, up US$15 from last week.

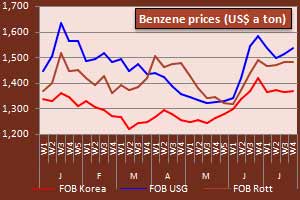

Benzene price fell more than 1% in Asia on Friday, tracking the retreat in US benzene market in the week ended 25 July. However, it was up on the week. In US, spot benzene pricing rose US cents 8 on the week, following a spike on Tuesday, to be assessed at US cents 513.95-514.05 a gallon FOB USG. In Asia, benzene prices fell US$12.50 on Friday but were up US$4 on the week, assessed at US$1,372-1,373 a ton FOB Korea. European benzene market ended flat after hitting 6-month high last week. Despite a general expiration of July nomination dates, there were some short to cover to balance July. European spot benzene price was assessed at US$1,474.50-1,475.50 a ton CIF ARA while FOB Rotterdam values were at US$1,484.50-1,485.50 a ton.

Courtesy: YnFx Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide