Indian textile companies foresee better business environment in coming quarter

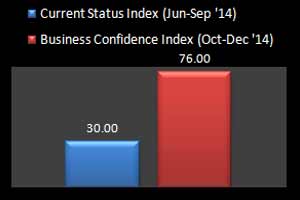

YarnsandFibers News Bureau 2014-09-24 10:30:00 – MumbaiTextile firms are looking forward to a major improvement in businesses in October to December 2014 quarter as prospects are brighter than preceding months and also being a festive season. The YarnsandFibers survey on Indian textile business confidence held in late September reveals that the Business Confidence Index (a measure of future prospect), for the quarter October to December stands at 76 as against the Current Business Status Index at 30.0 for the quarter July to September 2014. Index above 50 indicates business expansion while below 50 implies contraction of business.

Business in the quarter ending September was worse as export started dwindling and raw material prices peaking to new highs. The US Cotton Future peaked to the quarterly high of US$88.16 per pound in the third week of June while Cotlook ‘A’ clocked a high of US$91.45 per pound. However, both the benchmarks subsided to a low of US$62.49 and US$72.15, respectively in early August.

Exports to China slowed down and the impending cotton policy change has raised fears on the fibre pricing. Crude oil prices, after coming close to US$110 per barrel in late June have retreated back to around US$95 a barrel in the second week of September, easing cost pressure on manmade textiles.

The YnFx Business Margin Expectation Index, which measures the firms pricing capabilities for their end-product as well as for the inputs, stands at 63.0 for the ensuing quarter, indicating that companies will be able to realize better price for their product in combination of them paying lesser for their raw materials.

YnFx has re-launched its Quarterly Business Confidence survey on the Indian textile industry to assess the perception of textile companies. The first survey was conducted by YnFx for the quarter ended June 2005. In this survey the respondents were from almost all the key segments of the textile industry across India. The size of the companies ranged from Rs 1 billion to more than Rs 200 billion. These companies manufacture and export manmade fibre, spun yarns of cotton and MMF, polyester filament yarns, home textiles, fabric makers, garment makers and textile machinery makers. Their combined revenue in FY14 was Rs 620 billion accounting for 11.5% of the total industry size.

Medium to smaller size companies are better off compared to small and large size companies. Companies with turnover of over Rs.50 billion are optimist that their performance in the next quarter would be much better than the current level.

Size-wise representation consist of 16% large companies with turnover of more than Rs 50 billion, 32% of medium size with turnover between Rs 10 billion and Rs 50 billion, 24% of medium to small size with turnover between Rs 5 billion and Rs 10 billion and small size companies with turnover of less than Rs 5 billion.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide