Cotton yarn spinning has become more profitable now, but for how long?

YarnsandFibers News Bureau 2014-10-14 16:51:00 – MumbaiCotton yarn making has become more profitable now than considered, three months ago. And this has been facilitated by the rapid fall in cotton fibre prices over the same period. The margins have improved in all the three major cotton yarn producing economies of China, India and Pakistan. On an average, cotton prices have declined by between 15-25 per cent between June and end-September while cotton yarn prices have bucked 5-9 per cent in the comparable period.

YnFx has considered the most popular cotton yarn count – the 30s and 32s, to make the comparison, while on the cotton fibre front it has considered the benchmarks or popular variety in these three countries.

Entering the new marketing season (2014-15) cotton prices have been dwindling, reacting to any news reporting prospect of oversupply. Harvest in India is slated to touch 40 million bales in the current season. Rains and dry weather have been moving the US cotton futures on either side. The most recent event stating that old-crop supply had tightened amid expected wet interruption of the US harvest concerns on lint quality rose contributed to gains in cotton futures. In Pakistan buyers were worried about fresh rise in the rates and covered the forward deals as much as they can since the Trading Corporation of Pakistan announced to purchase cotton to stabilise prices. In India, cotton prices fell to the lowest levels in the current cotton year forcing Cotton Corporation of India to start procuring the fibre at minimum support price (MSP).

Cotton yarn markets have been fluctuating in weakness in recent times and spinning mills were pushing sales amid scattered demand. In India, cotton yarn prices began to fall while cotton prices plunged, losing about 15% in only four weeks. In Pakistan, cotton yarn markets lacked due to a number of changes in the market fundamentals including a dramatic fall of cotton prices, festive holidays, and a drop in value of currency.

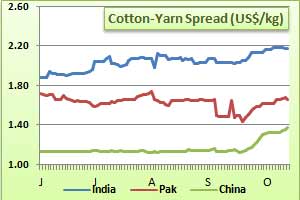

In India, 30s combed weaving yarn were pegged at INR195 per kg as of early October while Shankar-6 hovered around INR33,200 per candy. Thus the spread between the two works out to US$1.66 per kg. Comparatively, the values in early June were INR215 per kg, INR40,200 per candy and US$1.72 per kg, respectively.

Similarly the spread in Pakistan between export price of combed cotton yarn 30s CNF and Karachi Cotton Association's official spot rate works out to US$2.18 per kg as of early October as against US$1.88 per kg.

The spread is lowest in China at US$1.38 per kg comparing cotton Yarn 32s spot price in Jiangsu and Shengze and Cotton China Cotton Index (328) as of 10 October 2014. This was US$1.13 a kg in early June.

Thus, it is evident that the margins in cotton yarn making have increased across markets. But these are likely to hold ground in coming period since demand which is still robust, may weakening as the peak season peters away and cotton prices which are gyrating to early output and end-season inventory tune may start reacting to actual numbers that will flow in coming months. In case cotton prices start looking up, the low priced polyester fibre may come into action to take away some share of cotton textiles. However, production estimates from India and US appear that the fibre availability will increase this marketing season keeping price bursts in-check.

Courtesy: YnFx Weekly PriceWatch Report and Daily Textile Prices service

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide