Bangladesh pays more for cotton yarn imported from India than China

YarnsandFibers News Bureau 2015-04-09 15:30:00 – MumbaiThis is further to the story Spun yarn exports volume from India up in February, prices down published on 7 April. Although China was the largest importer of Indian spun yarns, especially cotton yarns, it paid much lower than the second largest importer, Bangladesh. This review covers the export of spun yarns from India presented in YnFx Fibre and Yarn Exports – India report, March 2015 a monthly report.

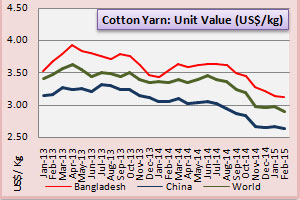

During February 2015, India exported 53.3 million kg of all kinds of spun yarns to China and 14.9 million kg to Bangladesh. Of these, 53.2 million kg and 13.2 million kg were cotton yarn, respectively and values were US$140 million for China and US$41 for Bangladesh. Thus the average unit value realisation for exporting cotton yarn to China and Bangladesh works out to US$2.64 per kg FOB India and US$3.12 per kg FOB India. The same values in February 2014 were US$3.06 a kg and US$3.55 per kg, respectively. Thus, the realisations have declined 14% and 12% for the two destinations from February 2014 and 2015.

Among the 73 countries to which cotton yarn was exported in February 2015, Jordan paid the least US$2.31 a kg and Japan paid the highest US$6.16 a kg. However, such a wide variation may have occurred due to size of the volume, quality differentials, deliverability, and other technical aspects. But for China and Bangladesh, these qualifications are assumed to be neutral since the cargo-mix could be the same on an average.

In February 2015, China imported cotton yarn at US cents 48 lower than Bangladesh and the same difference in 2014 was US cents 49 a kg. This implies that the difference has remained stagnant between both the markets.

Deciphering counts wise export of cotton yarn, to these two markets, shows the same result accepting in case of few counts. China was the largest importer of 32/1 cotton yarn with volumes at 24 million kg valued at US$67.6 million while Bangladesh imported 0.41 million kg worth US$1.3 million. Thus, unit value realisation works at US$2.81 a kg for China and US$3.15 a kg for Bangladesh. The differential between the two was US cents 34. Here, China had the advantage of larger volume over Bangladesh. In the same month, export of 30/1 yarn to Bangladesh stood at 3.15 million kg worth US$9.8 million and the same to China was 1.80 million kg worth US$5.30 million. Here, the unit value realisation was US$3.10 a kg for the former and US$2.98 for the latter. Again China was sold 30/1 at a price US cents12 lower than Bangladesh.

In similar comparison, China had advantage of US cents 7 for 40/1, US cents 21 for 20/1, US cents 63 for 24/1 and US cents 41 for 10/1 cotton yarns. In case of 28/1 cotton yarn, the volume to Bangladesh was much higher than China. Here, China bought Indian yarn at a higher price than sold to Bangladesh.

It is apparently evident that buyers in China are negotiating aggressively taking advantage of volume, which appears lacking in buyers from Bangladesh. Overall, higher volumes do have advantage of getting equilibrium in cotton yarn pricing.

Courtesy: YnFx Fibre and Yarn Exports – India report, March 2015

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide