Chemical fibres feedstock become costlier on demand supply imbalance

YarnsandFibers News Bureau 2015-03-10 18:03:00 – MumbaiCrude oil prices have been firming up in recent weeks but the general view is that they will remain relatively low for some time yet. While supply will remain, the demand side may see nothing change much. USA still gives mixed signals, even with the benefits of cheaper gasoline while in Europe there are many problems, especially in terms of low consumer demand in the north and low employment in the south.

Worldwide there is not enough demand for oil prices to go up, yet the textiles market could see bouts of intense competition. The fall in oil prices had initially progressively widened margins along the supply chain, but as margins steadied for fibres and textiles they could be squeezed in case oil firm up.

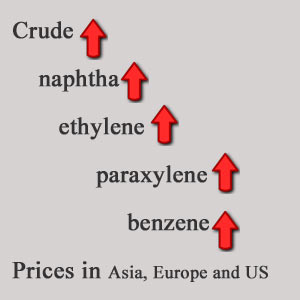

Firmer oil will force the petrochemical makers to either rationalise capacity to restore margins or hike prices. This could be achieved through raising intermediates prices which will feed down into fibres and textiles chain. But the beginning of cost support will emerge from feedstock, ethylene, paraxylene (for polyester chain), benzene (for nylon chain) and propylene (for acrylic chain).

In the month of February and the first week of March, all feedstock for textiles prices galloped across regions excepting in US for ethylene and propylene. Crude oil markets regained 10-30 per cent during these five weeks on support of the shrinking number of rigs drilling oil in the US while worries about the security of Libyan and Iraqi crude supplies also plugged the markets from falling in recent times. However, resurging US$ and fear that US may hike interest rate played negatively on the oil price rise.

Spot prices for propylene in Asia quickly responded to the firmer oil position, and stood at US$1,024-1,026 a ton FOB Korea in the first week of March. It was some US$225 above the bottom of the market seen in late January. All of this was not only cost-driven since demand remained subdued for most part of February and the return from the lunar New Year holiday. Tight supply also pushed prices up. Apart from the upcoming heavy turnaround season in South Korea, the unexpected shutdown of Japanese Maruzen Petrochemical's steam cracker at Chiba buoyed market sentiments. In USA, where prices showed signs of little firmness returning post holidays, fell in the week despite initial nominations for March was at an increase. In Europe, spot propylene prices rose following production issues and maintenance shutdown at major suppliers. The region faced two production issues - Dow began maintenance at main Terneuzen cracker. From end January to first week of March, propylene was dearer by 28-29 per cent in Asia and Europe, while it was 3 per cent cheaper in US.

After six months of decline, benzene prices appear to be at or close to bottom. In the USA the February contract dropped US cents 19 to US$2.01 per gallon, while in Europe the contract fell Euro 47 to Euro 521 a ton. In Asia, Nippon Oil settled its contract US$25 down at US$630. While contract prices were weakening, spot prices began to move higher - a sign that a market reached a point of price inflection. Asian benzene surged further tracking US gains and strong demand for May cargoes. Meanwhile, bullish sentiments caused benzene price to jump in Europe. In US benzene touched a four-month high on styrene demand and short-covering. Derivative styrene demand held firm as market participants eyed US export opportunities to Europe, which was ultimately leading to reductions in benzene supply. Benzene prices were up 31-33 per cent in Asian and European spot markets while they jumped 25 per cent in US between end-January and early March. This triggered cost support in downstream caprolactum and polyamide chip markets.

Supply crunch pushed ethylene prices up in Asian markets, lifting SEA values higher than NEA amid tighter supplies in the first week of March, taking the total rise of 24 per cent since end January. Meanwhile, the ethylene-naphtha spread hits highest level for 2015 led by a bullish ethylene market amid tight supplies. The impact of oil price rise was minimal since fundamentals tilted toward supply imbalance. Similarly, Asian rallies and planned, unplanned outages in Europe including improved margins on contract price hikes in Europe pushed spot ethylene prices up . Stronger naphtha was also a major contributor in the spurt. Competition from shale gas and lower February contract price settlement, subdued US ethylene spot price. While contracts settled at a 66-month low, spot hovered at 54-month low in US. There was some spot recovery after talks of production upsets as Williams Partners latest restart attempt was unsuccessful. In the past five weeks, ethylene spot prices in Asia and Europe were up 24 per cent and 12 per cent respectively, they fell two per cent in US.

Polyester feedstock, paraxylene was dearer by 14-18 per cent across all markets since end-January 2015, after having falling persistently in line with the drop in oil prices since June 2014. Buying sentiment improved with bids for Asian origin cargoes and discussion levels were seen above those for CFR Northeast Asia cargoes. US paraxylene market has been following peak and trough in Asia, and saw spot moves up 15 per cent in the past five weeks.

Overall, the drive in feedstock in recent weeks has more to do with supply impediments rather than demand and or costs. Being largely a maintenance season for most petrochemical units, supply will remain in deficit in a normal demand curve scenario. And this may continue for some time and keeping boosting their respective downstreams and finally to staple fibres and filament yarns. And in case demand improves, values all along the chain will be lifted, which may in turn provide support to falling crude oil prices, “ceteris paribusâ€.

Courtesy: YnFx Weekly PriceWatch Report

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide