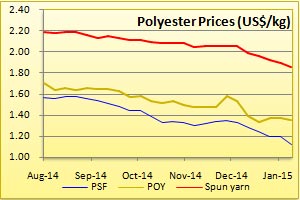

Filament and spun yarn prices retreating rapidly mirroring oil markets

YarnsandFibers News Bureau 2015-01-13 15:50:00 – MumbaiUntil now the immediate impact of the fall in crude oil prices was mostly on the upstream products of the textile value chains. The very first oil derivative to react was naphtha and further down in the chain each layer had or do have a lag to absorb and pass on the cost reduction since their raw material inventory was built at the earlier high prices. The effect began quickly in the immediate downstream segment and percolating slowly at the end of the value chain, ceteris paribus.

The last leg in the polyester chain, polyester staple and filament saw price falling in Asian markets while the same in Europe and US were yet to react. Similarly, in the nylon chain benzene market was the immediate casualty and filament yarns were least affected. Acrylic chain mirrored a similar trend.

The price data collected in the first complete week of January 2015 has something to decipher. The period post New Year Holiday and pre Lunar New Year holidays in China, is usually one of the weakest times for yarn markets, with the activity progressively slowing down across major producing and buying markets.

The Lag narrows

While oil prices started declining from late June early July, followed by feedstock and fibre intermediate until late July into early August, yarn prices – both filament and spun, started to show softness only in early September. This implies that the last leg now take at least three months to pass on easing cost to end-user. Further down, fabric prices are likely to show effect only in late January and the final garments and apparels by June 2015. However, in case oil price rebounds, which is expected to average US$61 a barrel over the next six months, after dropping in February and rising in March, the end products prices will not fully reflect or may pass on only 50 per cent drop in cost in between June 2014 and January 2015. In the interim they will have the advantage of oil price moving sideways to cover their position.

Sharper fall in November/December

Although the fall in fibres and yarns price began in early September the deceleration was seen from November and those escaped saw declines in December. US crude Futures lost 11% and 27% in these two months sequentially. Post New Year it lost another 11% taking the total loss to 40% and closing the week at an average of US$48.75 a barrel. Going down straight to the manmade fibres, the decline in pricing was slower post the beginning of downtrend in oil prices which had immediate impact on naphtha and feedstock – ethylene, benzene and propylene markets. Fibre intermediate – PTA, MEG, Caprolactum and acrylonitrile followed suite given the hand-to-mouth volume purchased by fibre and yarn makers in anticipation of further fall in raw material prices and with an intention of not building inventory at higher price. This happened in late to early September. Thus, fiber and filament yarn markets saw prices crashing only in November/December.

Market Intelligence

Ask for free sample Report

experience

Customer Base

dedicated team

Countries Served Worldwide